THE RATIONALE

The analysis performed in the previous section was done from a free market perspective to illustrate one point and one point only: free markets left to their own devices do not show (on average) any of the "risks" that the Chief Economist so proudly displays. Which begs the question; if the free markets do not behave in such a manner, then what is forcing them to do so? Excellent question grasshopper! Lets see:

…a sharper-than-expected slowdown in major emerging markets…

Why would emerging markets experience such problems? In a word? Economic mismanagement. If there are no issues internal to the markets themselves, then the only thing that's left are external problems. But what could be external to a market? What can be above a market? Simple. Governments! Thus the only possible explanation is that government action is causing a sharper slowdown.

…sudden escalation of financial market volatility…

This is simply due to money manipulation by Central Banks (see for example Central Banks Engines Of The Evil Empire or The 1.5 Quadrillion USD Bet - What Can Possibly Go Wrong or Austrian Economics For Dummies - Money or Fake Money For A Fake Economy or Real Money For A Real Economy). Think about it. If the amount of money would be constant, there would be no reason for financial volatility because the amount of money and credit would be more-or-less constant. In such an environment, the only manner in which financial market may become more volatile than usual is through "manias" i.e. the irrational behaviour of market participants in bubbles. But such bubbles are ridiculously infrequent in free markets. In manipulated markets, on the other hand, we have continuous Inflation, Asset Inflation and Booms and Busts (see for example The Austrian Business Cycle Theory) all the time. Basically, it is government action that is the ultimate enabler and culprit of such "financial market volatility". You remove Central Banks from the equation and such volatility disappears (for the most part) on its own!

…heightened geopolitical tensions…

If companies have no geopolitical tensions with other companies and/or their customers, then who or what is causing such geo-political tensions? We think that by now the word geo-political gives it away. Politics! And who creates and executes politics? You go it! Governments! Again, it is government action that creates such tensions, not the market.

…slowing activity in advanced economies…

If the natural trend of free markets is to remain in an approximate constant growth pattern, then what can be causing such a slowdown? What can change such a pattern? Only a factor external to free markets can do so. And what is external to the markets? Governments! Think government action such as messing around with interest rates, laws, regulation, taxation, bureaucracy, fees, import duties, and so on. Does the 2008 debacle sounds familiar? Of course! the slowdown is caused by previous, ongoing and future government action!

…diminished confidence in the effectiveness of policies to spur growth.

This says it directly. It is government action that is failing to "spur growth". Yet again, we must never forget that it was government action to begin with that killed growth in the first place! They are telling us that the majority of people don't believe that the government fix introduced to fix the latest economic disaster that the government created in the first place will work! Wow! What a surprise, not! Why should anybody in their right mind believe that the same people that have been screwing up the economy for the last 200+ year can now suddenly fix it? Of course not! They can't! Again, it is government action that is screwing up the economy by trying to fix it!

THE FIX

Now that we know what is causing the problem (i.e. government action), let's see what is that WB's Chief Economist recommends. In their own words:

Against this backdrop of weak growth, pronounced risks, and limited policy space, policymakers in emerging and developing economies should put a premium on enacting reforms, which, even if they seem difficult in the short run, foster stronger growth in the medium and the long run.

Among these measures, efforts to invest in infrastructure and education, health and other human skills and wellbeing, as well as initiatives to promote economic diversification and liberalize trade, will boost growth prospects and improve standards of living. The international community has an important role to play in the pursuit of these goals.

WOW! So the Chief Economist of the World Bank is suggesting as a cornerstone of a reactivation policy… drumroll please…spending!!! Yeah… sure… let's keep using the old tried-and-failed Keynessian so-called methodology that has brought to the peoples of the world so many booms and boosts alongside with historically unprecedented levels of public debts (as in the debt that governments created in your name and you will have to pay).

And what else is this luminary of the economic sciences recommending? Diversification! Sure! Let's get governments to decide what gets produced and to what degree. Because this has never been tried before… short of the USSR… and we all know how well this worked! Diversification! Give us a break! And how exactly are governments supposed to diversify their economies when not even the economies themselves are diversifying by themselves? Not to mention the case that forced diversification is oftentimes counterproductive because it increases the costs of such economic efforts. One of the most basic cornerstones of any economic cycle (as taught by mainstream economics) is that you want mass production because it is efficient! You don't want forced diversification. However, the benefits of mass production only occur if there is a free movement of goods and services. What's the point of having a warehouse full of inexpensive shoes if you are prevented from sell them to other people? And who prevents the free movement of goods and services? You got it! The government! (think borders and/or political divisions). Thus, because of artificial government actions increasing the costs of mass manufactured goods and services is that an even more expensive so-called "solution" (i.e. forced diversification) is recommended!

And this links quite nicely with yet another recommendation, the one about trade liberalization… which for once it actually makes sense… yet not entirely.

Why not recommending the outright abolishing of all borders and letting any good and service flow through? Why would trade need to be "liberalized" instead of barriers derogated altogether? Oh no! We can't do that. We can't do that because… because… because?? Hellooooooooo… Chief Economist…. Helloooooooo….

Thus trade need to be "liberalized" in the first place. And what does "liberalization" mean? In a word? Protectionism. Liberalization is not true free trade, it is nothing more than a maze of political decisions determining which goods or services will be allowed to be exchanged at what taxation level. Thus, liberalization will not solve the problem; it will only make it a little bit less awful!

And what about that first bit, the one about policymakers should put a premium on enacting reforms, which even if they seem difficult in the short run, foster stronger growth in the medium and the long run.

What does this gobbledygook mean? It simply means that the policies that the Chief Economist is recommending will create economic pain and misery but, it is hoped, will improve the economic conditions of the future. Suuuuuuuuure… Absopositively… Any day now… because this has been shown to work soooooooo well in the last 200+ years… of course… silly us… and we thought that economic history is there to be analysed, studied and conclusions about what works and what do not reached at. But no. Economic history is there for…errr… information purposes! Yeah! That's it. It is not to be studied but it is there to provide colorful background while governments repeat the same tired recipes that go nowhere and make our lives miserable time and time again. After all, what's the worst that can happen? Your life gets irreversibly screwed? So what? Don't you worry because your sacrifice will help "society"… oh… that's right… you are part of "society"… nevermind…

POLICY UNCERTAINTY

In a nutshell, the World Bank is acknowledging that the vast majority of the lost economic growth in the world is due to government action which they call "policy uncertainty" and "political instability". As such their ultimate recommendation is… more policies!!! Yes, the ones that did not work so far. This is so ingrained in WB's mind that in its January 2017 edition their Executive Summary summarizes the entire report as:

Global Outlook: Subdued Growth, Shifting Policies, Heightened Uncertainty.

For which we need to ask again, why do we tolerate Shifting Policies which create Heightened Uncertainty which produces Subdued Growth if we know that they are nothing more than government actions? Why do we allow governments to screw-up our lives?

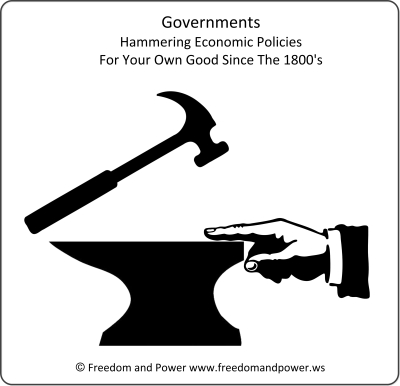

Allow us to put it in a simple way.

If you go to a doctor and you tell him that your finger hurts because you are constantly hammering it on purpose, what do you think that your doctor will tell you? Of course it will tell you to stop frigging hammering it!!!

Yet, this message, this such a simple message does not seem to percolate through the brains of the brainwashed so-called "society" that 200+ years of government education has managed to develop.

CONCLUSION

Look, this is not complicated. A pseudo-government organization which claims to be a cooperative of 189 countries is telling you, point blank and in no uncertain terms, that our economic debacles are produced by… government action (i.e. themselves)! And what is required to fix these government actions? More of the same, more government action! And you agree with them! Or you choose to keep supporting them and your government and your current political system by voting! Why is so? Why is that it is so hard to believe that yes, governments are to be blamed for the vast majority of our economic problems?!

The answer to that one, in an upcoming article.

Meanwhile the choice is yours. Economic prosperity or more of the same. You decide. Decide wisely. After all, the future of humanity is at stake. No pressure.

Note: please see the Glossary if you are unfamiliar with certain words.